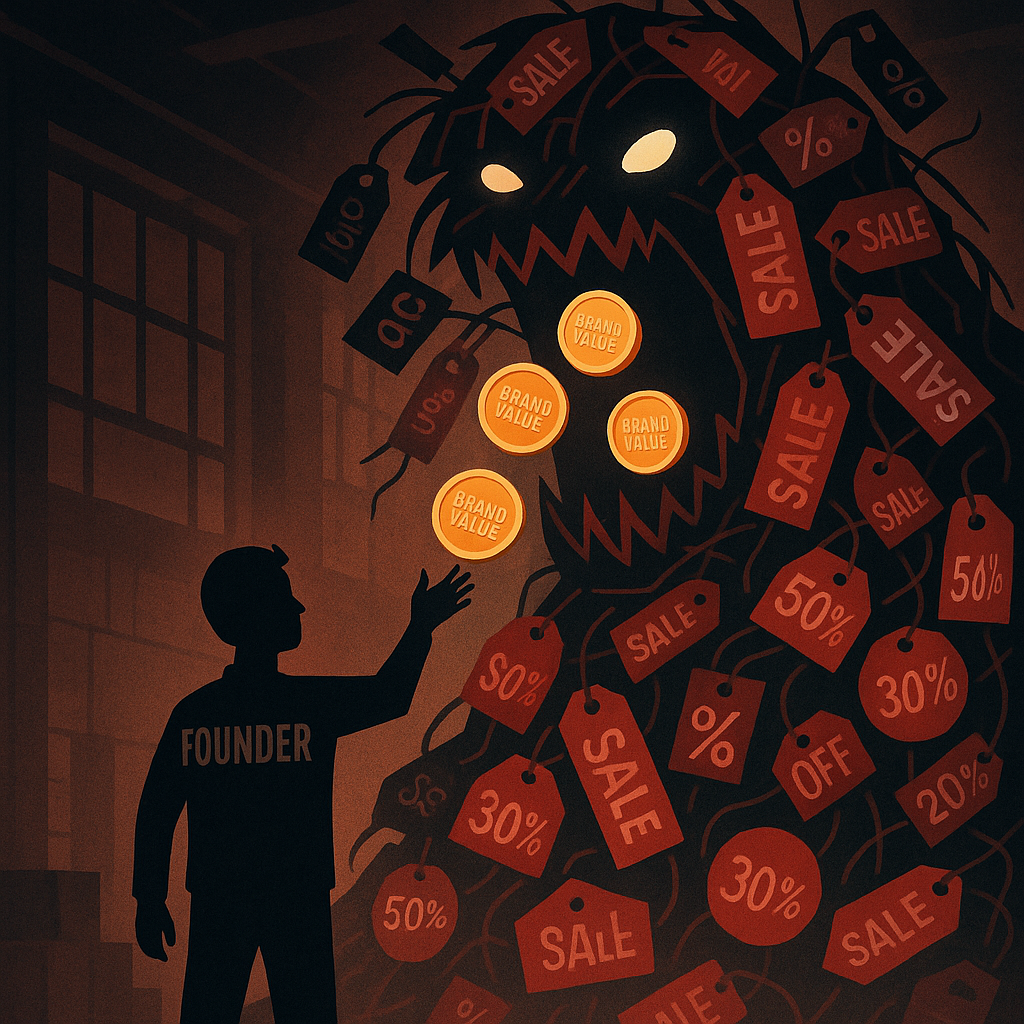

The Silent Killer of D2C: Discount Addiction

In the race to win customers, many direct-to-consumer (D2C) brands reach for the fastest lever they know: discounts.

And on the surface, it works. Slashing prices creates urgency, drives traffic, and boosts sales — at least temporarily. But behind the scenes, heavy discounting erodes margins, trains customers to devalue your products, and makes it nearly impossible to scale sustainably.

The truth? Discounting is like a sugar rush for your business — a quick high followed by a crash that’s harder to recover from each time.

Let’s unpack why pure discounting often backfires, and look at real-world cases — including two from India — where it caused more harm than good.

Why Pure Discounting is a Dangerous Habit

Before diving into the examples, here’s why it’s such a slippery slope:

- Trains deal-seeker behavior: Customers learn to wait for sales and avoid full-price purchases.

- Erodes brand equity: Premium positioning is lost when products are constantly marked down.

- Kills margins: Discounts eat into profit, making it harder to reinvest in growth.

- Short-term thinking: Brands focus on today’s sales spike instead of tomorrow’s sustainability.

5 Real-World Cases Where Discounting Backfired

1. Jabong (India)

Once a rising star in Indian fashion e-commerce, Jabong leaned heavily on 60–80% off offers to fight Flipkart and Myntra. While the approach drove traffic, it destroyed margins and weakened brand positioning. Customers rarely bought without a deal, and when VC funding slowed, Jabong couldn’t pivot to full-price selling. In 2020, it was shut down after being acquired by Flipkart via Myntra.

Lesson: Discounts can buy traffic, not loyalty.

2. Snapdeal (India)

At its peak, Snapdeal fueled GMV growth with deep discounts during flash sales and festive seasons. Once discount budgets were slashed, repeat customers vanished, and market share collapsed in the face of Amazon and Flipkart.

Lesson: A discount-fueled growth engine stalls when the fuel runs out.

3. JC Penney (USA)

For years, JC Penney trained shoppers to wait for deals. When CEO Ron Johnson tried to switch to “everyday low pricing,” customers revolted. Foot traffic plunged, sales tanked, and the brand had to revert to its old strategy — but the damage was done.

Lesson: Over-discounting creates habits you can’t easily undo.

4. Michael Kors (Global)

The luxury accessories giant pushed constant markdowns in outlets and online channels to chase sales targets. This eroded its aspirational image, and customers stopped paying full price. Michael Kors later had to scale back wholesale exposure and limit discounts to repair its brand.

Lesson: In premium categories, discounts are brand poison.

5. GAP (Global)

With endless “40% off everything” promos, GAP conditioned customers to see its products as commodities. New launches struggled at full price, margins stayed thin, and the brand’s position as a casualwear leader faded.

Lesson: If your default marketing lever is discounting, you’re in a race to the bottom.

Breaking the Cycle: Retention Over Rebates

The brands that scale sustainably in 2025 aren’t chasing bigger discounts — they’re compounding value through:

- Memorable product experiences customers want to return for.

- Personalized nudges that engage based on behavior, not just price sensitivity.

- Real-time insights to understand what drives loyalty in different customer segments.

Discounts aren’t evil. They have their place — for clearing seasonal stock, introducing new products, or winning back dormant users. But when they become the only growth lever, you’re not building a brand — you’re running a clearance rack.

Bottom line:

In D2C, discount addiction is the silent killer of sustainable growth. Win customers with relevance, keep them with experience, and price your products in a way that protects both your margins and your brand.